Out-of-the-box solutions that streamline your operations

HUB Reporting

HUB makes the production of reporting easier. Enable faster, reliable and more accurate performance reports,

factsheets and investor-level reporting

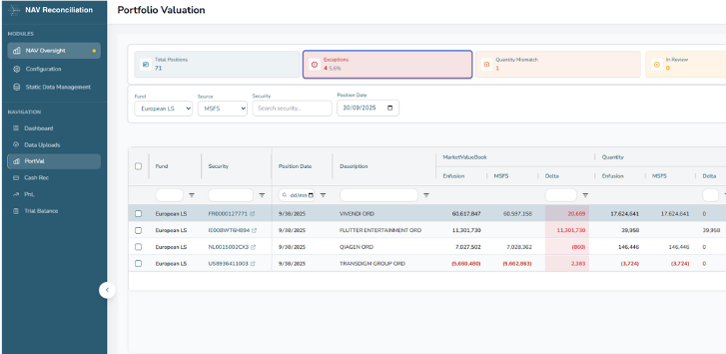

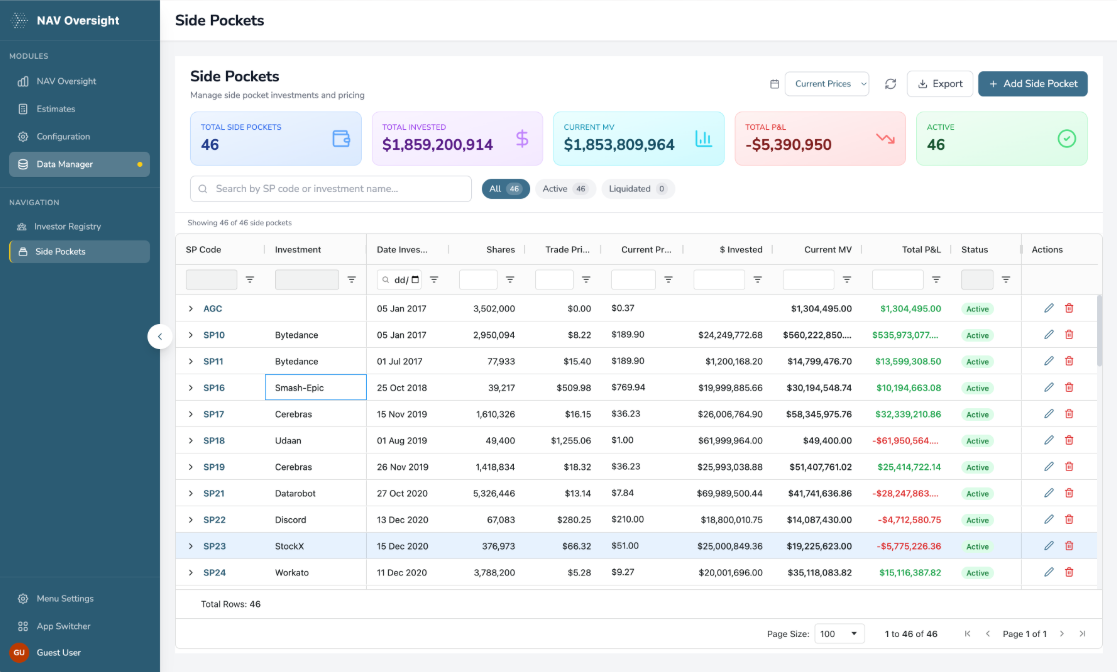

HUB NAV Reconciliations & Oversight

HUB makes NAV reconciliations and oversight easier, simplifying daily tasks by automating complex and manual processes

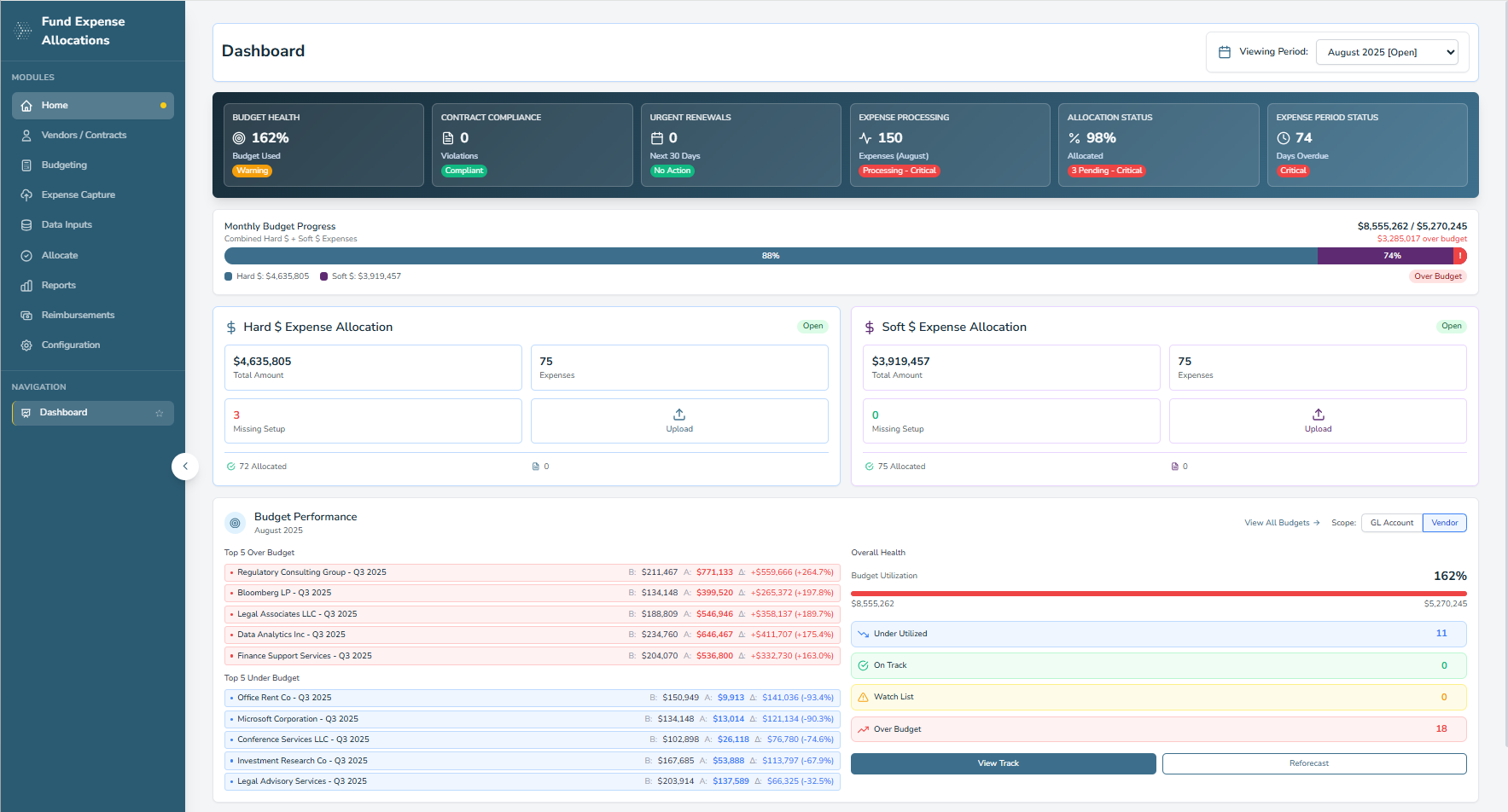

HUB Fund Expense Allocations

Streamlines fund expense allocations by automating invoice capture, vendor contract management, budgeting, exception detection, and fund-level expense verification

HUB Fund Operations

HUB replaces replaces manual workflows and spreadsheet reconciliations with automated data capture and easy to use workflows for P&L, cash and portfolio reconciliation, NAV controls, pricing, and limit management

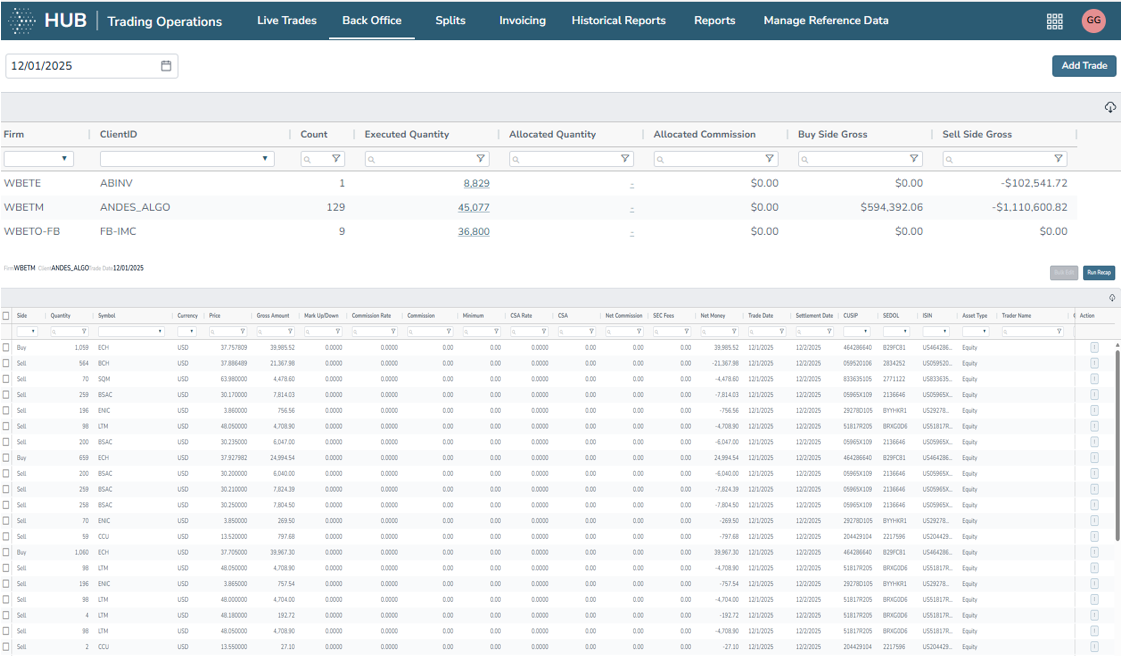

HUB Trade Manager

Automates and controls Trade and Position file management between OMS to prime brokers, matching systems, fund admins, and risk systems

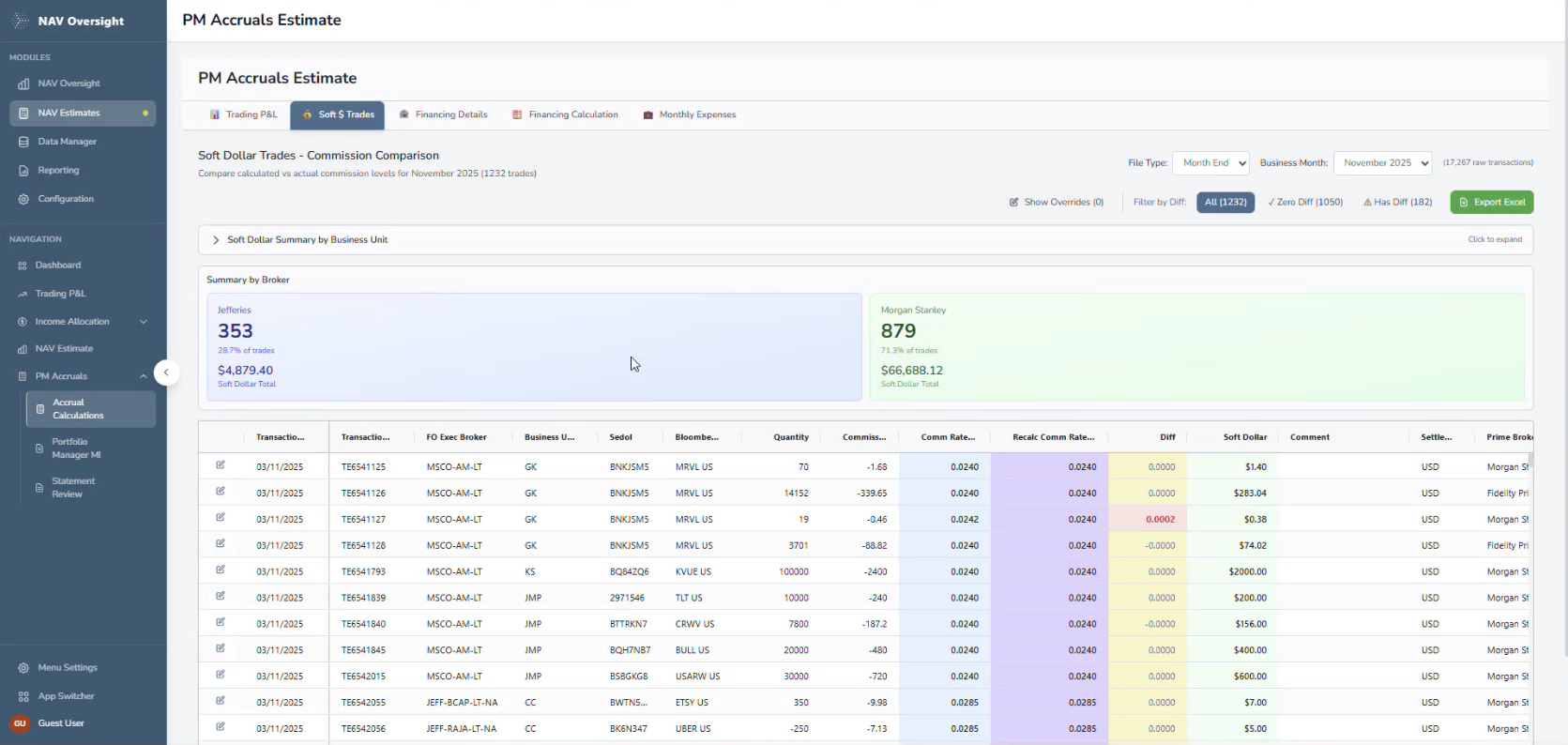

HUB Desk Economics

A firmwide view of net performance across all PMs daily. HUB calculates PM-level net P&L, incorporating trading P&L, financing, expenses, soft dollars, fee allocations, and deal-specific mechanics such as loss carry-forward

HUB IRR & MOIC Reporting

HUB IRR & MOIC Reporting replaces spreadsheets for private markets performance reporting. Automatically calculates IRR & MOIC at investment, fund, and investor level

HUB Income Allocations

HUB enables hedge funds to automate investor income, fee, and performance allocations with full control, transparency,

and auditability.

.png)

HUB NAV Estimates

Daily internal NAV estimates from trading close inputs, separates back-dated adjustments, versions month-endstates, and automates the GAV to NAV bridge

.png)

Customer Case Studies

DigitalBridge

DigitalBridge is a $100bn US-based alternative asset manager , operating across liquid hedge funds, private credit, and private equity strategies

They sought to enhance and scale their NAV oversight process, ensuring accurate and timely access to a trusted source of NAV share price data from both internal and external sources.

Gresham House

Gresham House is a specialist investment manager which aims to protect wealth and deliver financial returns for institutional and private clients through investments in public equities, real estate and forestry.

With increasing fund complexity, Gresham House saw an opportunity to improve the frequency and personalization of performance reports to their investors.

Lansdowne Partners

Lansdowne Partners is a $9.5bn UK investment firm known for its long-term, value-oriented approach.

With a diverse portfolio and a reputation for disciplined investing, Lansdowne required a modern, scalable solution to support its growing operational and reporting demands.